Stay on top of your finances with our Reconciliations Services

Let us help you catch up and effortlessly maintain accurate records. Contact us today to get started!

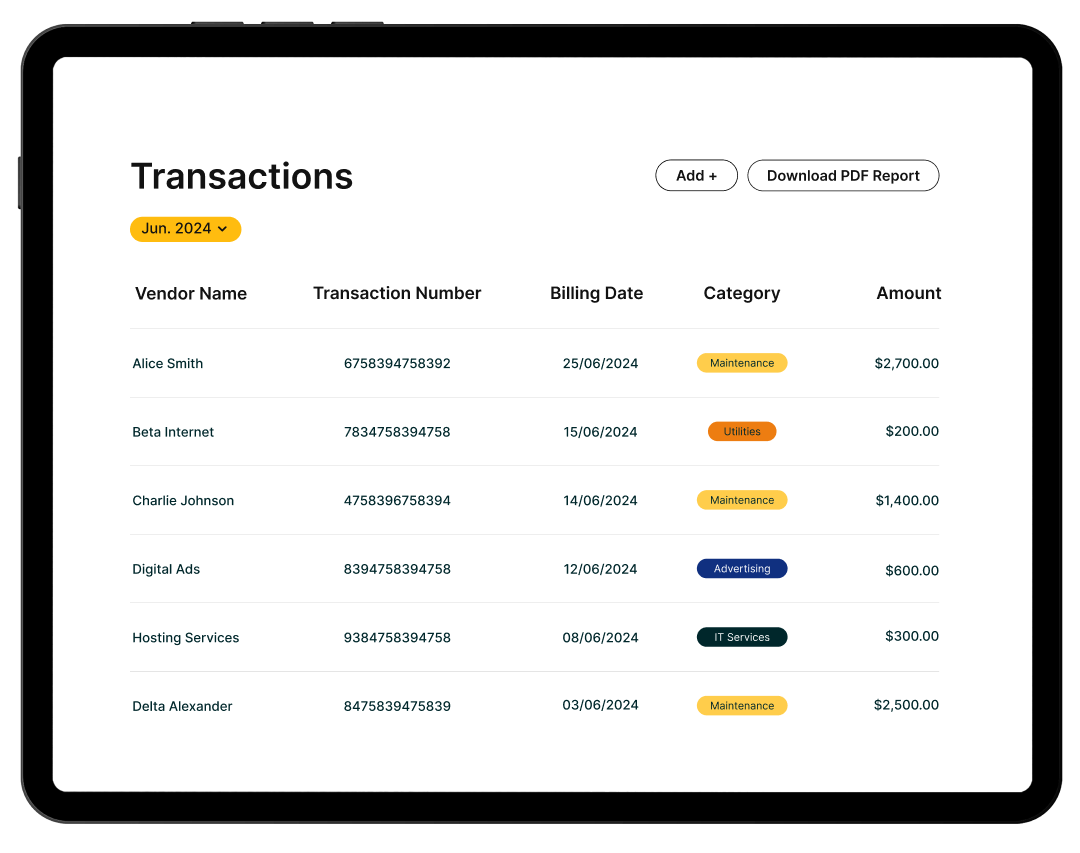

Complete your bank reconciliations quickly and efficiently, starting with the crucial and challenging first month and smoothly extending to all subsequent months. Our team of experts will soon bring you up to date and in balance. We meticulously review your bank statements to ensure every transaction is accurately recorded.

Our Customers Love Us

Capabilities:

Benefits of Daily Reconciliations Service – Catch-Up

Accuracy of Financial Records

Identify and correct any discrepancies, missing entries, or errors to maintain precise and reliable financial information for property management companies.

Timely Decision-Making

Timely and accurate financial data is essential for making informed decisions regarding budgeting, cash flow management, and other financial aspects of property management.

Compliance and Transparency

Updated financial records instil trust with property owners, tenants, and regulatory authorities, showcasing a dedication to financial integrity and accountability.

Required Documents for Book Cleanup

For a typical cleanup, we require bank statements or, ideally, view-only bank access to help with missing transactions. Check images and deposit breakdowns are also beneficial for accurate recordings.

Availability During Cleanup

The more accessible your designated team members are, the faster we can complete the cleanup and transition you to our recurring services. Delays can increase costs, so we aim to proceed efficiently to keep expenses down.

Expectations from Property Management Company

We need at least one contact with your database's accounting history, including move-outs, move-ins, bank transaction history, and unreconciled deposits or checks.

Leave the Numbers to Us,

Focus on Your Properties

Schedule a Call

Faqs

Frequently Asked Questions

Bank reconciliation offers several advantages, including:

- Detecting errors like double payments, missed payments, and calculation mistakes

- Tracking and recording bank fees and penalties in the financial records

- Spotting fraudulent transactions and theft

- Managing accounts payable and accounts receivable

The main advantages of bank reconciliation and cleanup are:

- Detecting errors such as double payments, missed payments, and calculation mistakes

- Recording and tracking bank fees and penalties in the accounting records

- Spotting fraudulent transactions and theft

- Managing accounts payable and accounts receivable

Contact Us

Schedule a Consultation.

sales@accubooks.ai

Delaware, US

Address